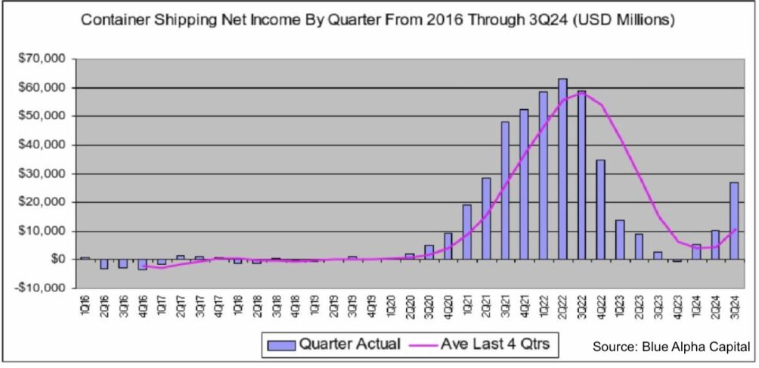

The liner shipping industry is on track to have its most profitable year since the pandemic began. Data Blue Alpha Capital, led by John McCown, shows that the container shipping industry's total net income in the third quarter was $26.8 billion, 164% increase from the $10.2 billion reported in the second quarter.

Compared to the third quarter of last year, this quarter's net income increased by $24 billion, or 856%, from $2.8 billion.

From a third-quarter perspective, the $26. billion in revenue is more than twice the annual revenue of the container shipping industry in any year prior to the pandemic.

The stunningly strong earnings in 204 are due to the Red Sea shipping crisis and strong trading volumes across all trade routes.

The third quarter's revenue of $26.8 billion is more twice the annual revenue of the container shipping industry in any year prior to the pandemic.

Linerlytica analysts, in their analysis of global listed shipping companies', noted that the EBIT margins of the nine largest listed liner companies increased from 16% in the previous quarter to 33%. However, there a significant gap between the best and worst performers, with Hapag-Lloyd and Maersk lagging far behind their peers. The average EBIT margin the two partners in the newly formed Gemini Alliance was 23%, less than half of Evergreen's 50.5% margin.

In a report yesterday, Blue Alpha Capital said, "There are signs that the third quarter of 24 is the peak, but there are many recent catalysts." Analyst at Sea-Intelligence hold the same view, noting in their recent weekly report: "We have now clearly passed the peak of 2024, which supported by the Red Sea crisis."

Although various spot indices have fallen from recent highs, Blue Alpha Capital expects strong liner earnings in the fourth quarter, a trend is being confirmed at ports around the world.

For example, the two largest ports in the United States, the ports of Los Angeles and Long Beach, set new records October.

Los Angeles Port Executive Director Gene Seroka commented, "The strong and sustained cargo volumes are likely to continue in the coming months due to strong consumer, the early lunar new year, importers' concerns about unresolved labor issues on the east coast, and new tariffs that could push up transportation costs next year."

a recent report, the brokerage firm Braemar noted, "The current market is driven not only by demand but also by a series of micro-inefficiencies are keeping the freight and charter markets active."

Today's release of the Drewry Container Composite Index fell $28 to $3,412.8 per FEU, 67% lower than the last pandemic peak of $10,377 in September 2021, but 40% higher than the pre-pandemic average of $1,420 in 2019

Our main service:

·Sea Ship

·Air Ship

·One Piece Dropshipping From Overseas Warehouse

Welcome to inquire about prices with us:

Contact: ivy@szwayota.com.cn

Whatsapp:+86 13632646894

Phone/Wechat : +86 17898460377

Post time: Nov-26-2024