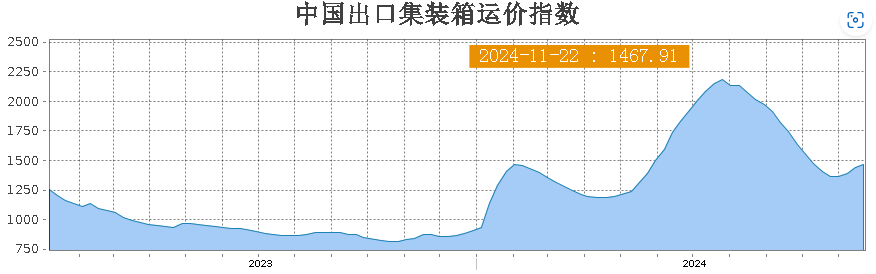

According to the Shanghai Shipping Exchange, on November 22, the Shanghai Export Container Composite Freight Index stood at 2,160.8 points, down 91.82 points from the previous period; the China Export Container Freight Index stood at 1,467.9 points, up 2% from the previous period.

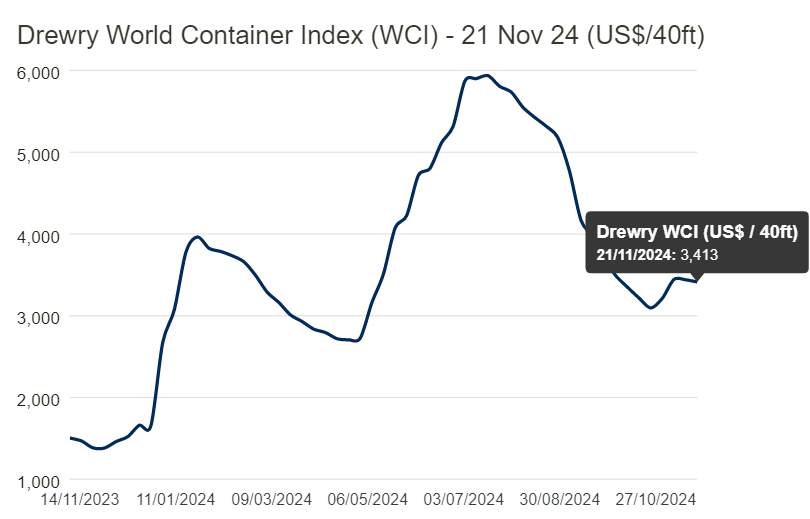

Drewry's World Container Index (WCI) fell 1% week-on-week (to November 21) to about $3413/FEU, down 67% from the pandemic peak of $10,377/FEU in September 201 and 140% higher than the pre-pandemic 2019 average of $1,420/FEU.

Drewry's report further pointed out that, as of November 21, this year's average composite index was $3,98/FEU, $1,132 higher than the 10-year average rate of $2,848/FEU.

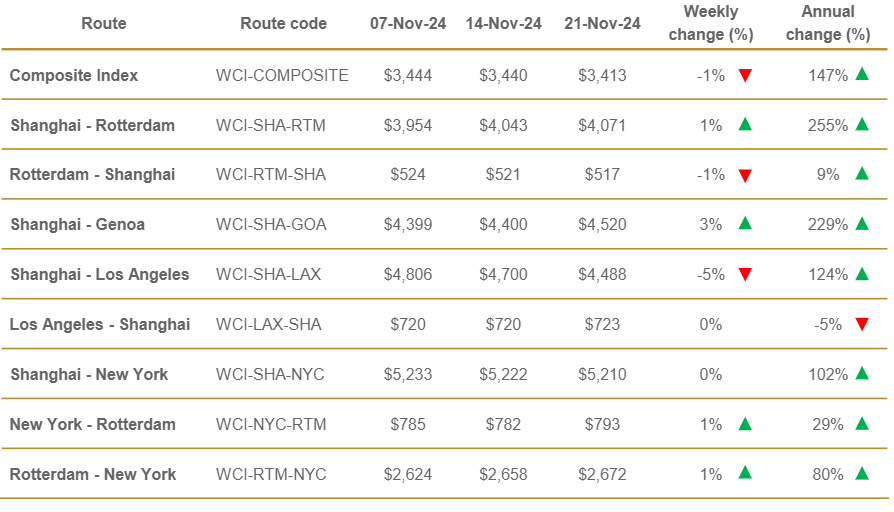

Among them, the routes departing from China saw Shanghai-Rotterdam increase by 1% to $4,071/FEU compared last week, Shanghai-Genoa rise by 3% to around $4,520/FEU, Shanghai-New York at $5,20/FEU, and Shanghai-Los Angeles drop by 5% to $4,488/FEU. Drewry expects rates to remain next week.

The specific route fares are as follows:

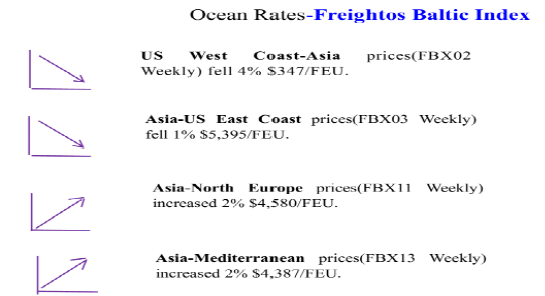

The latest edition of the Baltic Exchange's Freightos Container Freight Index (as of November 22) shows that the global container freight index reached3,612$/FEU.

In addition to a slight increase in rates from Asia to the Mediterranean and Northern Europe, rates from the US West Coast to Asia fell by 4 and from Asia to the US East Coast by 1%.

In addition, according to industry insiders, freight rates across almost all routes declined this week. The reason is that during the National Day Week, the supply was reduced due to reduced sailings, and the three-day strike in the US East Coast diverted some cargoes to the US West Coast, driving up the rates on the US West Coast. However, as we enter November, the supply of sailings has returned to normal, but the volume of goods decreased, leading to a correction in the rates on the US West Coast.

On the other hand, the shipping for the Double 11 e-commerce season has to an end, and the market is now entering the traditional off-season. It remains to be seen whether the market will experience a peak in demand from mid- to before the Spring Festival. Meanwhile, the progress in negotiations between dock workers in the US East Coast regarding the automation of dock equipment, changes in tariff policies after's inauguration, and the early lunar new year this year, which brings longer factory downtime, are all factors that could impact the shipping market.

Faced with uncertainties as the threat of tariffs from Trump, the upcoming Spring Festival peak, and potential port strikes, the global shipping market is full of uncertainties. As freight rates fluct and demand changes, the industry needs to closely monitor market dynamics to flexibly adjust strategies to face the upcoming challenges and opportunities.

Our main service:

·One Piece Dropshipping From Overseas Warehouse

Welcome to inquire about prices with us:

Contact: ivy@szwayota.com.cn

Whatsapp:+86 13632646894

Phone/Wechat : +86 17898460377

Post time: Dec-04-2024